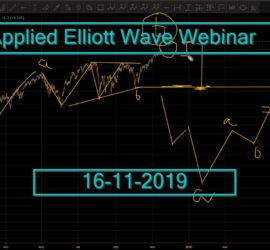

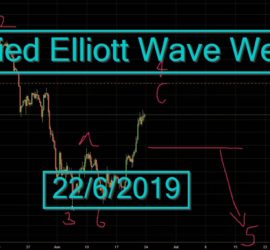

14. Applied Elliott Wave Webinar (Crude, Gold, SPX, Nifty, Natural Gas + NSE Stocks) Feb. – Mar. 2020

In this webinar I have discussed practical application of Elliott Wave using various chart including Crude Oil, Natural Gas, Gold, SPX, Nifty 50, Reliance (NSE Stock), Tata Motors (NSE Stock), Biocon (NSE Stock) . Possible trading strategies using Elliott Wave for February and March 2020 have also been discussed wherever […]