In the last analysis my main count suggested that Nifty will show a downward movement which it did.

In this weeks Elliott Wave Analysis of Nifty I will be discussing the 2 possibilities that can play out in the days to come.

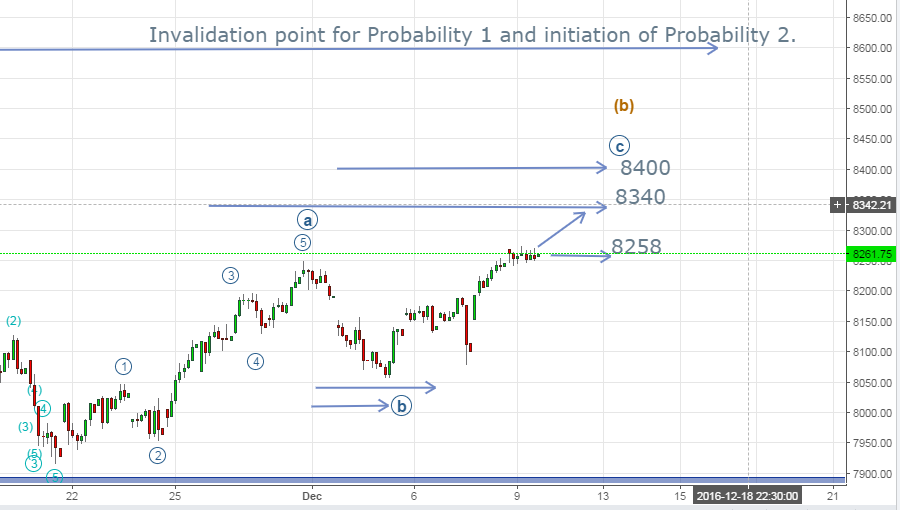

Probability 1 :

Nifty will move up in a Wave c progression of the Wave B ( of one higher degree ) and go on to achieve the upper levels of

Level 1 @ 8250 ( Already Achieved )

Level 2 @ 8340

Level 3 @ 8400

After this the next leg would be the Wave C of the last Zig Zag and would be a leg down to the levels of 7900 – 7650 or even below, that would only become clear by looking at the then Wave structure.

Note : You should also consider the probability that Wave B can be a Flat or a Triangle and I expect you already know what kind of trading strategies can be employed in that scenario.

Probability 2 :

Wave C was completed near the 7916 region and recent up move from there on is the new leg up, the Wave iii of 5 of (3) to be precise.

In that case we will most certainly test the 8965 levels and probably go even higher.

You can have a more detailed view in the video report below.

Video Report :

To receive these updates at the earliest you can subscribe to my Emailing List.

Learn to trade using Elliott Wave Principles – My Video Course

View the previous Nifty Elliott Wave Report here.

Disclaimer – All content presented here is strictly for educational purpose, do read the complete site disclaimer before taking any action.