Crude Oil so far is moving as projected in my last video report.

Below I have discussed more possible scenarios with a detailed look at the 4 hour and 1 hour charts.

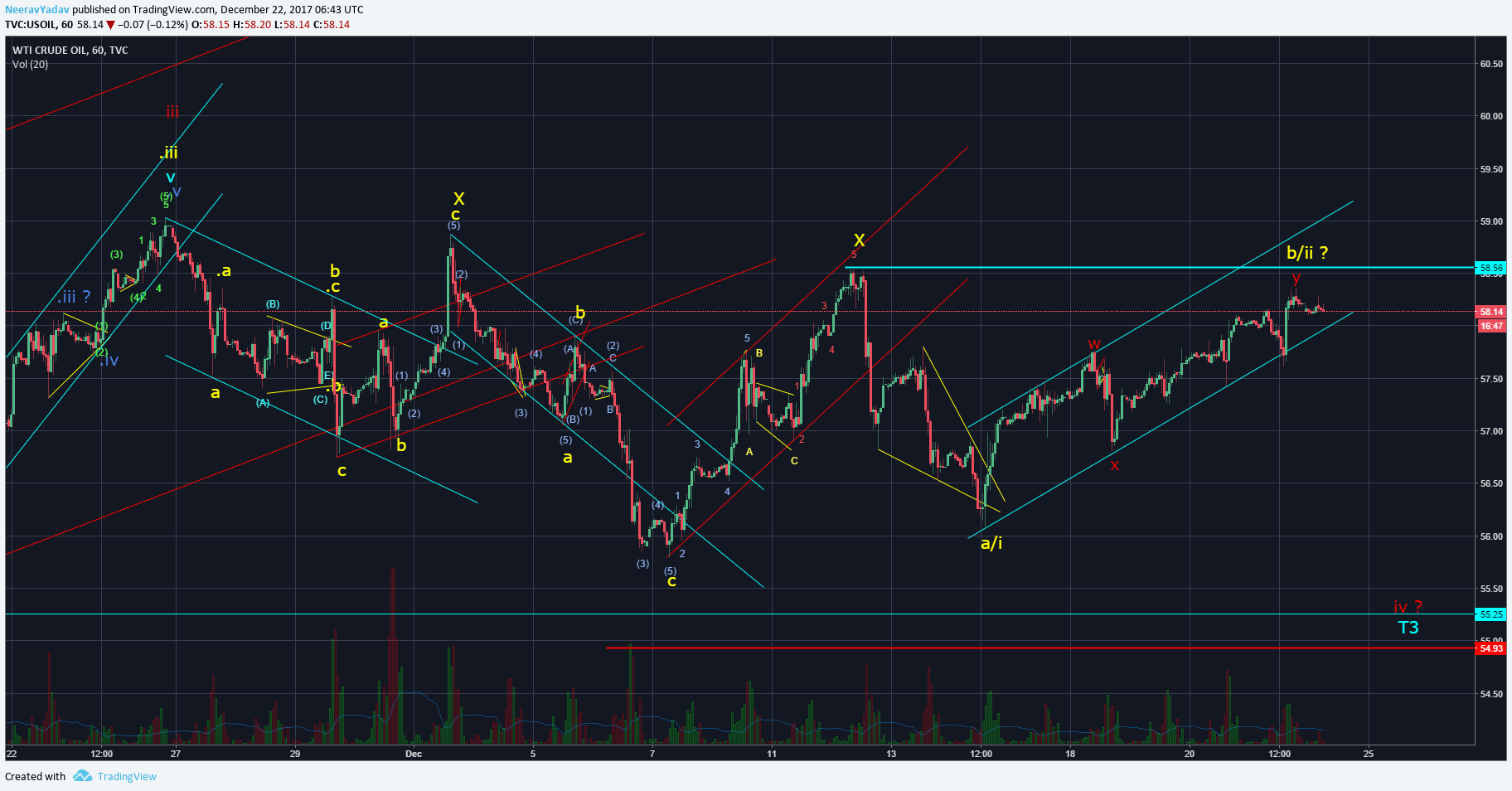

I currently have 2 counts that I’m following in regards to Crude, the first one above (Read only the Red labels) is taking the current Wave iv progression as a Triangle and the other one down below is taking W.iv as a Complex Correction.

As per both of these counts the Invalidation Level is coming around 58.56, which means that a move above that level would mean the Invalidation of both of these Hypos.

Given the above counts and the current price of Crude being around 58.19 we have a very low risk shorting opportunity over here which can take prices down to even the 55.25 levels.

Even if we consider the Bullish scenario, that is Hypo 3 (Yellow Count) given below in which I have taken Wave A of the Triangle as a Double Zig Zag, even then we come to the same conclusion that we must see Crude heading lower to atleast 56.95 levels for Wave E completion, this in terms presents us with a very Low Risk and Very High Probability short setup.

Let’s see how this market progresses.

Get 1 month free entry to the private group and learn to trade using Elliott Wave Principles – My Video Course

To receive these updates at the earliest you can subscribe to my Emailing List.

Disclaimer – All content presented here is strictly for educational purpose, do read the complete site disclaimer before taking any action.